FedEx’s $9B Deal, Waymo's ‘Door Closers’ & The AI Bill Comes Due: This Week’s Logistics News

FedEx & Advent Buy InPost for $9.2 Billion

The biggest deal of the year (so far) just dropped. A consortium led by FedEx and private equity firm Advent International has agreed to acquire European parcel locker giant InPost for €9.2 billion. This is a massive bet on "Out-of-Home" (OOH) delivery. By locking down InPost's network of automated lockers across Europe, FedEx gains immediate density and a lower-cost last-mile solution to compete with DHL and local carriers. The "doorstep" is getting expensive; the "locker" is the new battleground. Source: WSJ

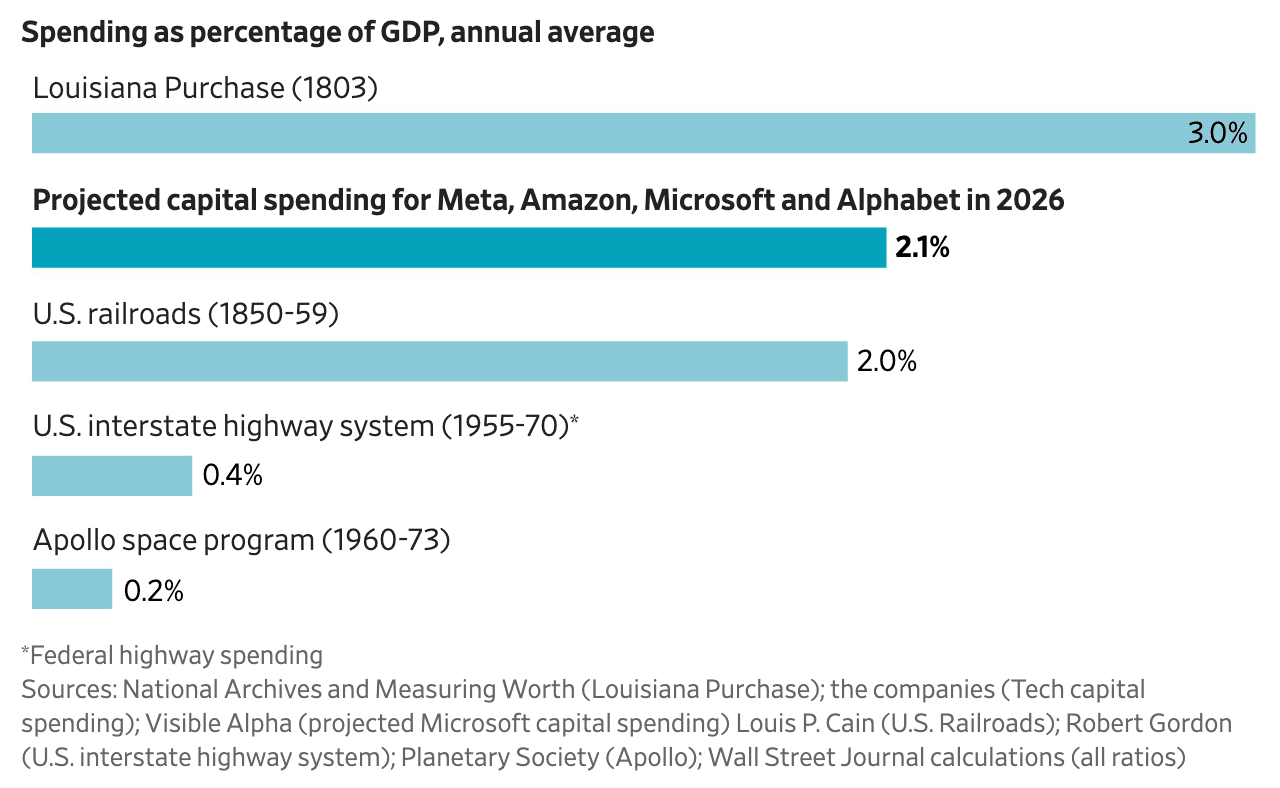

Big Tech’s AI Bill: The Spending Spree vs. Reality

The WSJ released a startling comparison of AI capital expenditure this past week. Tech giants are pouring billions into AI infrastructure - far outpacing the current revenue it generates. The report highlights a "circularity" problem where much of the reported AI revenue is just tech companies selling services to other tech companies (or startups they invested in). As the depreciation bills for all those GPUs start hitting the books in 2026, the market is asking: Where is the real-world ROI? Source: WSJ

Shopify Sets the Pace

Shopify released its Q4 results, dropping a killer earnings report that proves they are running full throttle while the rest of the market tries to keep up. Here is the breakdown of the absolute heaters they just threw:

🚀 The "Killer" Metrics:

Gross Merchandise Volume ("GMV") surged 31% YoY to $123.8B for Q4.

Q4 revenue hit $3.67B, up 31% YoY.

They are printing cash with a 19% Free Cash Flow margin ($715M) in Q4.

They’ve secured a massive ~14% of the entire U.S. e-commerce market.

International revenue growth clocked in at 36%, proving this isn't just a North American success story.

On top of that, they announced a $2B share repurchase program, signaling massive confidence in their own stock.

GXO Reports "Flat" Results, Eyes New Verticals

Contract logistics giant GXO reported its Q4 numbers this past week, showing decent revenue growth but "flat" earnings performance. CEO Patrick Kelleher signaled a shift away from pure M&A and toward organic growth in high-value verticals. Specifically, GXO is targeting Aerospace, Defense, and Life Sciences - sectors that are less sensitive to consumer spending swings. If retail is volatile, GXO wants to be moving missiles and medicine instead. Source: The Loadstar

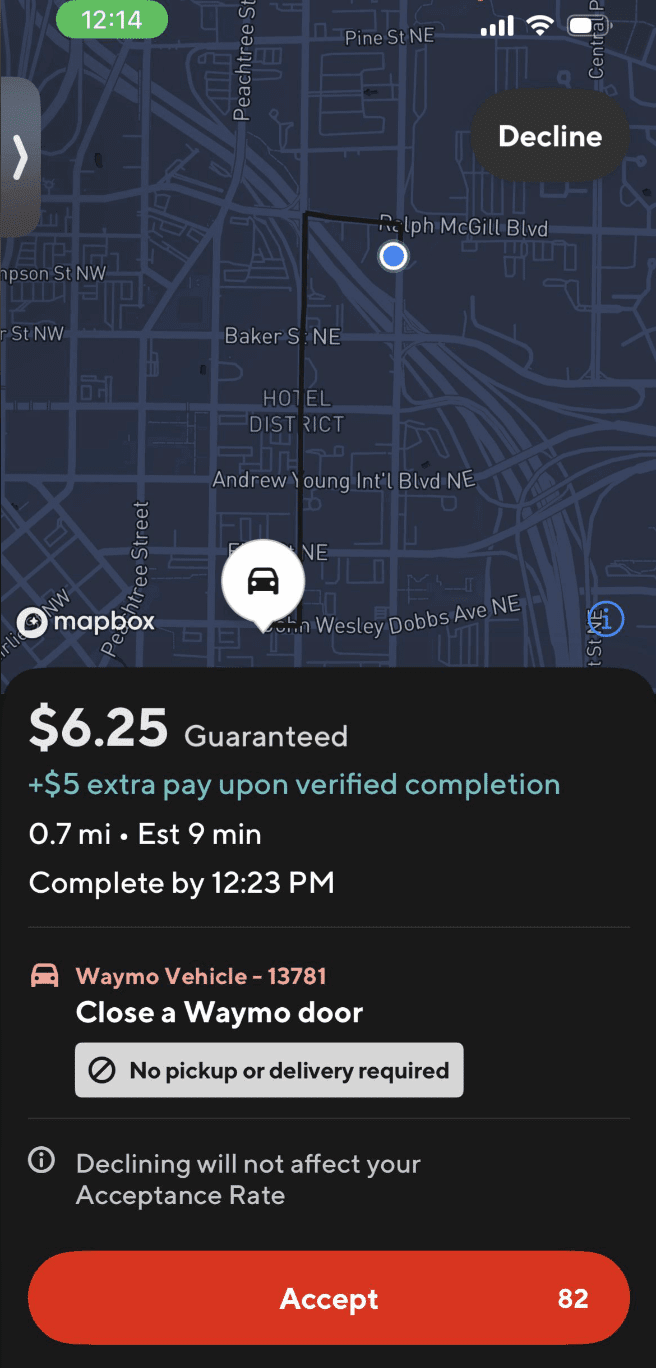

DoorDash Drivers Have a New Gig: Closing Robotaxi Doors

In the strangest "gig economy crossover" of 2026, Waymo is reportedly paying DoorDash drivers to close the doors of its autonomous vehicles. A pilot program in Atlanta notifies nearby Dashers when a Waymo vehicle is stuck because a passenger left a door ajar. Drivers can accept the "mission," drive to the car, close the door, and get paid. Even the most advanced AI on the planet still needs a human hand to do the simple stuff. Imagine telling your kids one day that your first job was DoorDashing and closing doors of Waymo’s 🙂↔️ Source: CNBC/Reddit

Close a Waymo door and get paid.